After spending most of the last two months researching cryptocurrency non-stop, I’ve gone from being a skeptic of Bitcoin to a raving fan. Here is what everyone new to cryptocurrency should know about Bitcoin and how to buy it.

And before I get too deep into this, remember that none of this is investment advice.

And before I get too deep into this, remember that none of this is investment advice.

My research has led me to the conclusion that cryptocurrencies are superior to fiat currencies (i.e. traditional money such as dollars, euros, pesos etc.) and will eventually replace them. A bold statement, I know.

Now I’m not saying I think this will happen tomorrow – it might be 20 years from now, or even 100 years from now, and there’s going to be a lot of ups and downs in the meantime – but I truly believe it’s only a matter of time before fiat currency is kicked to the curb and cryptocurrency takes its place. Here’s a brief summary of 6 things Bitcoin has going for it.

- No single entity or person owns it – it’s decentralized, open source, and controlled by its users.

- No-one can close your account for doing something you don’t like (i.e. when you store your coins in your own wallet, rather than on an exchange). For most of us, this isn’t an issue even with fiat currency… but hell, it’s nice to know we have this protection with Bitcoin.

- Similarly to gold, there is a limited supply. Better than gold, everyone knows exactly how many Bitcoin there will ever be: 21 million. No single person or entity can devalue Bitcoin by simply deciding to create more of them.

- With current computing power, the blockchain that keeps track of everyone’s Bitcoin wallets, including how much they contain and transfers from one wallet to another, is un-hackable. Until we develop quantum computing, this isn’t likely to change. And by the time we do develop quantum computing, the blockchain can be adapted accordingly.

- Bitcoin can be as private and anonymous as cash, for those who choose to use it that way.

- Unlike cash, people can transfer Bitcoin and other cryptocurrencies electronically from one person to another (in any country!) without using a middle man such as bank or wire transfer service. All you need is your computer or smart phone.

Before you put any money into Bitcoin, I think it’s a good idea to try to understand what you’re investing in. With that in mind, here are a couple of articles about cryptocurrency that made a lot of sense to me:

- Man Who’s Invested Over $400,000 Investing in Bitcoin Reveals His Strategy – the value of this article is NOT in the clickbait headline about the 400k (so please ignore that), but in his excellent explanation of what Bitcoin and cryptocurrencies are and why this matters. It’s a long read – bookmark it and read it later when you have time to concentrate on it.

- You Don’t Understand Bitcoin Because You Think Money Is Real – I liked this article because it delves into another criticism of Bitcoin that I hear often. It’s a short read compared to article #1. But read both – they each cover important points.

Of course, there are also plenty of pundits who are dismissing Bitcoin as nothing more than a passing fad. And you can find plenty of those if you wish to look for them. But after reading an obscene amount of articles on the topic over the past couple of months, I’m placing my bets on Bitcoin NOT being a mere fad. Obviously there are no guarantees, but this is my conclusion for now.

Alright, onwards.

Necessary security precautions

With the freedom of cyrptocurrency comes responsibility and before you invest a dime in cryptocurrency you need to educate yourself on how to stay safe online. Unlike fiat currency in a bank, there are fewer done-for-you safety nets to protect your cryptocurrency coins from theft and it’s completely up to you to take care of this. Here are the two major points of vulnerability you need to think about:

- A thief hacking into the online wallets where you store your cryptocurrency.

- A thief stealing your offline wallet

Risk #1 is mostly simple to protect against by taking three simple precautions to maximize your safety online:

- Use unique usernames and passwords for your accounts on exchanges. You’ll most likely be using an exchange to buy your coins, and maybe even store them. Make sure no-one other than you can get into that account.

- Use 2-factor authentication on every exchange you use to buy and sell cryptocurrencies. Yes, it’s a bit of a pain in the a$$. But it’s better than losing your coins to some hacker who put a keylogger on your computer and got a hold of your username and password. Don’t worry about it if you don’t know how to use 2-factor authentication at this very moment because the exchanges make it simple to do for total beginners. If you can read instructions, you can use 2-factor, ok? 🙂

- Use a strong password for the email associated with your trading accounts on exchanges. Do NOT, under any circumstances, use a weak easy-to-remember password. In fact, if you haven’t updated your email password in a while, do it now so you don’t forget. When you’re done, come back here and finish reading. (I’m not kidding… do it now!!!)

There’s still the chance that a hacker could hack into the back end of the exchange itself (rather than logging into your account pretending to be you). This happened back in 2014 – early days in the world of Bitcoin – on an exchange called Mt Gox (read about it here). Nowadays, if using a reputable, well-established exchange, I liken the risk of this to being about as likely as a bank robber taking your money from your bank’s vault. It can happen, but it’s not likely. To further lower your risk, exchanges like CoinBase allow you to create “cold storage” wallets where your cryptocurrency is stored offline – because if it’s not online a hacker will have a terribly tough time getting into it, right?

Storing your cryptocurrency offline

And if you get to the point where you have cryptocurrency that’s worth a lot of money, it’s probably a good time to consider investing in hardware wallet.

Why is this better than keeping it in Coinbase’s offline storage?

Because if you keep it on Coinbase, THEY control your coins and if Coinbase goes out of business (unlikely, but possible), your cryptocurrency stored with them could be gone forever. Whereas in a hardware wallet, you have complete control of and access to your coins. For this reason, if I ever end up with ten grand or more of cryptocurrency that I’m not using for active trading, I’m thinking I’ll move it into a Ledger wallet.

The best of the best are the ones made by Trezor. Another excellent option is Ledger, with their Nano Ledger model being the most popular. You can check them out here.

***Do not buy a Trezor or Ledger hardware wallet anywhere other than the original manufacturer’s site. If you buy one from some other site (even if it’s a big well-known site), there’s a chance you’ll get a counterfeit device, which too big a risk to take with your crypto.***

February 2018 update: I found an interesting article detailing a man-in-the-middle attack that hardware wallets could be susceptible to. Most importantly, this article explains a simple way to avoid becoming a victim of such an attack. You can read all about it here.

But remember – if you’re just getting started with a small amount of money, both the Trezor and Ledger are probably overkill since the Trezor costs 89 Euros (about 105 USD) and the Ledger costs 58 Euros (about 69USD) at the time of this writing. I know, that’s not USD – welcome to the international world of cryptocurrency! 🙂 In any case, you can always use Google to get an idea of what the Euros you’re being charged are equal to in USD.

I’m still using all of my crypto for active trading, which means it’s all on exchanges at the moment – but when I get to the point where I want to put some into cold storage offline to hold longterm, the Ledger is the tool I’m going to use for this.

Lingo you need to know

If you spend any time reading about crypto, particularly in online forums and Facebook groups, you’re going to come across some shorthand that’ll be foreign to you. Here are some of the most common acronyms you’ll see and what they mean:

ATH: all time high – buying at an all time high can be risky, and should never be done unless you’re damned sure you plan on holding that coin for the long term, even through the inevitable ups and downs.

Check out this recent all time high for Bitcoin, and the big dip in price that followed – anyone who bought in at the high banking on making a quick buck and selling for profit was sorely disappointed to see this today, I guarantee you that:

Alt coins: a cryptocurrency coin that’s not Bitcoin (Ex. Ethereum, Litecoin, Ripple, Bitcoin Cash, etc.)

BTC: the trading symbol for Bitcoin – it’s analogous to the ticker symbol of a stock (ex. Facebook = FB)

Buy the dip: Many investors will only buy a cryptocurrency coin when the price drops a bit after a previous high. I’ve been doing this for almost all of my short term purchases.

If you’re very conservative, you’d wait for a massive dip like this one (see the yellow circle).

If you were less conservative, you might have bought back in June when the coin dipped, or maybe even during the July and August dips.

DYOR: do your own research

Fiat: traditional money like Dollars, Euros, Pesos etc.

FOMO: fear of missing out – it generally refers to situations where investors buy on impulse when the price of a coin is rapidly climbing because they worry they’d be missing out on profits if they don’t. FOMO buys can lead to paying too much for your crypto and suffering losses when it later falls. Do your best to avoid FOMO impulse buys.

FUD: fear, uncertainty, doubt

HODL: someone’s drunken tweet intended to say “hold” that caught on and now means “hold on for dear life” – in other words, the value of your coins will go up and down, but if you believe in their long-term value, you’ll hold on for dear life, and refuse to sell until you make your target profit.

ICO: initial coin offering – this is kind of like a pre-sale (and analogous to an IPO in the stock market), where you can buy a coin before it’s tradable on the open market. However, these aren’t regulated like IPO’s, so are higher risk. Research carefully before you put any money into one of these and be aware that the vast majority of them fail.

SAT: a satoshi – each bitcoin is made up of 100 million satoshis – I think of them as Bitcoin’s version of the penny, except there’s 100 million of them per Bitcoin (as opposed to 100 pennies per Dollar). Prices of alt coins are often expressed in terms of how much Bitcoin it will cost you. Bitcoin prices are always shown with 8 decimal places to reflect the fact that there are 100 million satoshis per bitcoin. To wrap my head around that in easy-to-visualize numbers, I think of 1 bitcoin as having commas and pretend I don’t see the decimal as follows: 1.00,000,000 (ignore the decimal). Do you see the 100 million satoshis now?

When you see some other coin, such as Ethereum (ETH), priced at 0.05134000 BTC/ETH, work your way from the final (eighth) zero and plug in your commas every 3 digits to get 5,134,000 satoshis to buy one Ethereum coin.

Here’s another example. You may see a coin like Ripple (XRP) priced at 0.00006728 BTC/XRP. Work your way back from the final (eighth) zero and plug in your commas every 3 digits to get 6,728 satoshis to buy one Ripple.

Whale: someone who can impact the price of a coin by selling or buying a very large amount.

3 rules for new cryptocurrency investors

- Do not, under any circumstances, invest money you can’t afford to lose. The cryptocurrency market is highly volatile and the price swings of 50% (or even close to 100%!) in a single day are not unheard of. You need to be able to sleep at night when this happens – by investing only play money (money you can afford to lose), you can have fun investing in cryptocurrency without the stress. Sure, it’s all fun and games when the price goes up by that much – but can you stomach holding through a downturn of that amount? Make damned sure you can, okay? I’ve invested in alt coins that plunged by 50% after I bought them, and later rebounded to 30% higher than my purchase price. That’s a lot of volatility to ride out!

- When starting out, it’s best to only invest in coins you believe in over the long haul. If you believe in a coin’s long-term value, you’ll find it much easier to ignore price fluctuations and hold on until the price rebounds.

- Decide on what your strategy will be. Do you want to throw some money into this and leave it there for 5 years? Or do you want to be an active trader who tries to buy and sell profitably as the price rises and falls. For long-term holders, the price you buy at isn’t as important since you plan on keeping your coins no matter what happens with short-term price fluctuations. But if you only intended to keep your money in for a few days, weeks, or months, then you need to study the market carefully to maximize your odds of buying the dips.

Now that I’ve scared you with tales of exchange hacking, price crashes, and so on, my hope is that I’ve prevented you from getting carried away and putting money you can’t afford into crypto.

I have my cash tied up in real estate because that’s my long-term investment plan – it’s predictable, people will always need a place to live, and it will provide me with a big retirement nest egg when I’m old and grey. My holdings are worth over 1 million dollars.

So how much did I put into crypto? 1 thousand dollars. Peanuts in comparison to what I have in real estate.

Play money is where it’s at.

Even if I make a killing selling books, my excess cash will go to paying off my real estate faster, not buying more crypto.

Look, I think crypto has enormous upside and I’m really excited about it or I wouldn’t be writing this post. Since I don’t want to be out of the game entirely, I put in my 1000 bucks. But because – in the big scheme of things – it’s so new and I might be wrong, I don’t think it’s wise to put an amount of money into it that would hurt me or really peeve me off if I lose it.

So I recommend you do the same if you see the same potential in crypto that I do. Use your play money. Don’t look at crypto as a get-rich-quick scheme and don’t put everything you have into it. Don’t be crazy and borrow money to invest in it either. Be careful and choose the amount of money you put into it wisely. Be patient. And whatever is meant to be will be.

The idea is to NOT put yourself in a position where you feel like this:

And instead, to be like this no matter what’s happening in the crypto market:

Like I said, I started out with about 1000 bucks. I lost some of it doing stuff I now know enough to avoid. After dusting myself off from those losses, I proceeded to use Bitcoin I bought to make itty bitty investments into alt coins that I thought had high odds of outperforming Bitcoin. For now, Bitcoin is King of Crypto and likely to stay that way, so my strategy is to make as much of it as I can in this manner. Making more Bitcoin without spending any more of my own money is a win, and it brings down my adjusted cost base for my Bitcoin. Today my portfolio is worth about 3000 dollars, or triple my initial investment in only 2 short months.

On Binance (one of the exchanges I use for trading alt coins) I’ve used these short term trades to bring my adjusted cost base for Bitcoin down from about 6700 USD to about 4700 USD. This means that although the price was 6700 USD per Bitcoin when I bought in using fiat currency, I’ve now got more of it (without spending more money), and this has brought my average cost per Bitcoin down to 4700 USD. As long as the price of Bitcoin is higher than 4700 USD, I’m still in position of profit.

On Bittrex (another exchange I use for trading alt coins), I’ve brought my adjusted cost base for Bitcoin down from about 9600 USD to about 6900 USD.

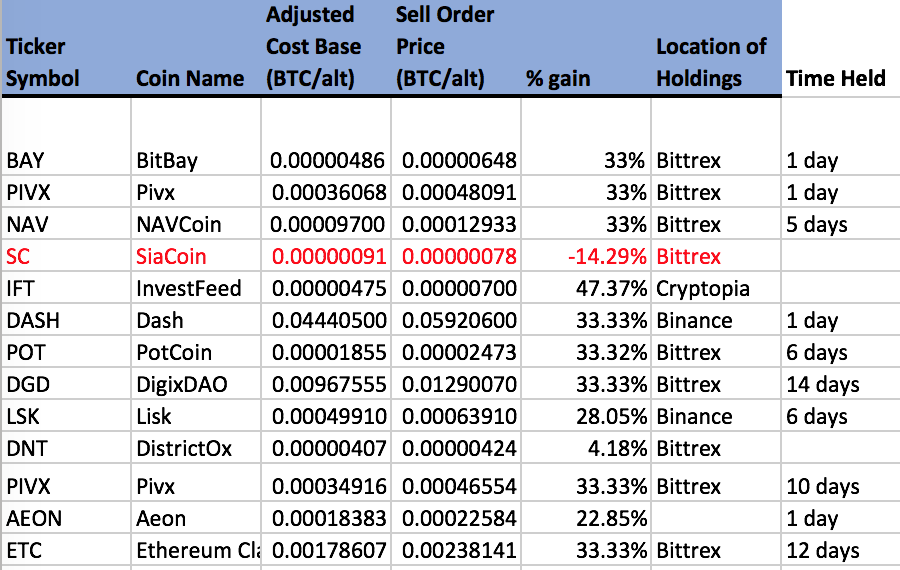

Here’s a sampling of some of my trades – my goal was to sell each of these for more Bitcoin than it cost me to buy them in the first place:

SiaCoin was an experiment and I chickened out when it started to drop. 🙂

I got into short term trading because at the time I jumped into Bitcoin, I’d bought Bitcoin at (or near) an all time high and was nervous about the price falling dramatically. Sure, it was play money, but I still preferred to make it grow every week, not watch it shrink (even if the shrinking would only be temporary). And although I was willing to hold for years and ride out any downturns, actively making moves to lower my adjusted cost base of Bitcoin was a way for me to feel more in control of the whole thing and lessen my exposure to risk.

Many people prefer to just buy their Bitcoin once and hold it long term. I know some people who put in 50 bucks a week no matter what the price (dollar cost averaging).

You do you. Whatever you have the time for and lets you sleep at night is a good bet. Remember – use your play money though, and never put in money you can’t afford to lose.

How to buy Bitcoin

The answer to this depends on what country you live in, people in the U.S. usually use Coinbase because it’s the easiest one to access and understand when you’re new to this. If you use this link to buy more than 100 USD of cryptocurrency on their site, you’ll get 10 bucks of free Bitcoin and so will I.

To the cynics: I don’t recommend things I don’t believe in. I need to sleep at night, after all. But let’s face it – writing this article took an awful lot of time. 🙂 If you found it helpful and decide to set up an account on Coinbase, I’d really appreciate it if you’d use my link to sign up.

Now that THAT’S out of the way… let’s keep going…

Coinbase will let you move USD from your credit card or bank account into a virtual wallet on Coinbase. Then you can use that money to buy Bitcoin.

Important: if you use your credit card to buy Bitcoin, make sure you’re using play money you can afford to pay off in full when your credit card statement arrives.

If you want to “buy the dip” and hold long term, you should know that Bitcoin’s price today has been down from its all time high… it might be a good time to jump in. As with anything in the crypto space, no-one can tell you for sure what’s going to happen next. It might drop more before going up again shortly after, it might drop more and stay there for a while, it might turn around and start going up any second. You need to prepare yourself for this mentally so you don’t stress out. Using only your play money makes the whole “don’t stress out” thing much easier.

One more detail…

When I first bought Bitcoin, I also put some money into Ethereum and Litecoin. I don’t like having all of my eggs in one basket and that offered a way to diversify my cryptocurrency investments. You’ll see those available on Coinbase too, after you’ve set up your account.

Resource recap:

Coinbase – a good exchange for beginners who want to easily buy Bitcoin – if you use this link, we both get 10 bucks of free Bitcoin.

Ledger Wallet – a quality offline wallet to store your Bitcoin and other cryptocurrencies

Well, that’s just about 3000 words on Bitcoin for Beginners to get you started. Please comment and let me know what you think or ask questions. And if you know others who’d like this article, please share it! 🙂

Hi Avery! I totally agree with you that Bitcoin and cryptocurrency in general will one day replace our current fiat system. It is the wave of the future. I talk to people about it all the time and I encourage those who are not already involved with cryptocurrency to definitely get involved. Like you, I’m very careful not to put money in it that I can’t afford to lose. Having recently taken a nosedive of more than $6,000, it is extremely volatile. But I think I’ve used it wisely so far. I’ve paid a couple of bills with it and I actually used it recently to pay for some emergency dental work. Right now, I’m a happy cryptocurrency camper and I don’t worry about the volatility of it.

Keep up your great work. I loved your book, “Turn Your Computer Into a Money Machine.” Becoming a free lance writer is a good fit for me. I have a strong background in English and journalism. I’m currently in the process of setting up a website.

Keep in touch! Talk soon.

Harvey

Yeah, Bitcoin is really something. Prior to researching it, it sounded like fake, make-believe money to me. But now that I’ve learned about how it works, I sure wish I’d looked into it a few years ago because holy crap, it’s genius! 😀

And I’m glad to hear you found my book on freelance writing helpful – back when I started it blew my mind that I could start off as a nobody with no experience or credentials and people would pay me to write for them based on writing samples alone!

Great Article on Bitcoin Avery! Thank you for the info. So much to learn!

My pleasure! I’m glad you found it helpful 🙂